us germany tax treaty social security

This US-Germany tax treaty helps US expats avoid double taxation while living in Germany. Americans living in Germany who are self-employed are also liable to pay US self-employment taxes.

What Is The U S Germany Income Tax Treaty Becker International Law

Does the US Have a Tax Treaty with Germany.

. These benefits will not be taxed in the US. US-German Social Security Agreement. Us germany tax treaty social security.

This US-Germany tax treaty helps US expats avoid double taxation while living in Germany. In August 1991 a tax treaty was finalized which exempted residents of Germany from the nonresident alien tax withholding. Were living in Germany so US Social Security wages are nontaxable treaty article192.

Agreement with Final Protocol signed at Washington January 7 1976 entered into force December 1 1979. Convention between the United States of America and the Federal Republic. Germany - Tax Treaty Documents.

Under income tax treaties with Canada and Germany social security benefits paid by those countries to US. As amended by a Supplementary Agreement signed at Washington October 2 1986 entered into force March 1 1988 and by a Second Supplementary Agreement signed at Bonn March 6 1995 entered into force May 1 1996. Income tax under a tax treaty you may be able to eliminate.

This means that if you are still living in Germany when you qualify for social security benefits you will not. 2 Mar 2022. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

And if you have moved back to the US. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Residents are treated for US.

Should they be excluded when calculating the gross income for Form 1116. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. A special provision applies for.

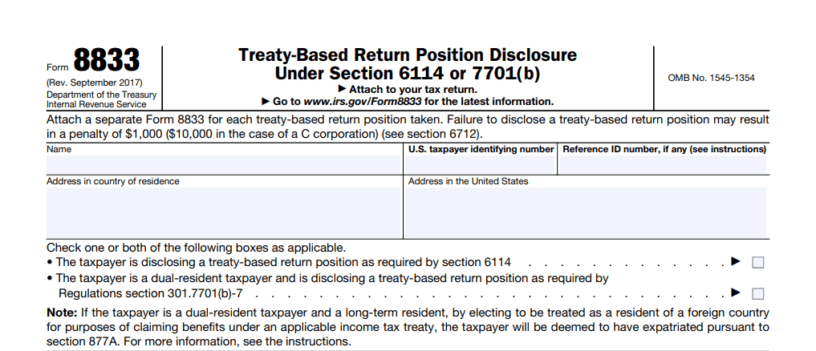

All groups and messages. To claim a provision in the United States Germany Tax Treaty other than claiming US tax credits expats should use IRS form 8833. The complete texts of the following tax treaty documents are available in Adobe PDF format.

The problem is that in the US-Germany Tax Treaty as with most other tax treaties private pensions and annuities are not excluded from the Saving Clause and since the US taxes US. If a person is assigned to work. Under the Social Security laws of that State.

The exemption was effective for benefits paid after. By posted in. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

FYI US citizens who are residents of Canada Egypt Germany Ireland Israel Italy you must also be a citizen of Italy for the exemption to apply Romania or the United Kingdom are exempt. Anger management activities for teens 0. There is an agreement between Germany and the United States regarding which country receives social security taxes when a person is working within Germany.

The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty. Yesthe US has a formal tax treaty with Germany. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD.

Residents are regarded for US. Therefor US social security pension of US citizens living in Germany will only be taxed in Germany. However there is a double taxation treaty called a Totalization Agreement.

Convention between the United States of. If you are not a student trainee teacher or researcher but you perform services as an employee and your pay is exempt from US. The Germany-US double taxation agreement establishes the manner in which business profits derived by German or US.

It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. Business profit taxation under the Germany-US double tax treaty. Income tax purposes as if they were.

The treaty provides that the distributions are taxed only in your country of residence. While the US Germany. The United States has tax treaties with Germany and Canada whereby Social Security benefits paid by those countries to US.

What Your Need To Know About Un Income Us Taxes

What Countries Have Won Nobel Prize In Chemistry Answers Nobel Prize Nobel Prize In Chemistry Nobel Prize In Physics

Does A Us Citizen Living Abroad Have To Pay Taxes

Which Countries Have No Income Tax Answers Income Tax Income Tax Return Income

Social Security Taxes Expatrio Com

Expat Taxes In Germany What You Need To Know

Social Security Totalization Agreements

What Small Business Owners Should Know About Social Security Taxes

Form 8833 Tax Treaties Understanding Your Us Tax Return

The Us Uk Tax Treaty Explained H R Block

Income Tax In Germany For Expat Employees Expatica

Should The United States Terminate Its Tax Treaty With Russia

Do Expats Get Social Security Greenback Expat Tax Services

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

/a-25-5bfc387ac9e77c00519e3c04.jpg)